Gold (XAUUSD) trading within a strong bullish structure today, hovering around the $3,960 level as investors evaluated mixed macroeconomic signals and awaited fresh data from the United States. Despite temporary intraday pullbacks, the overall trend remains positive, driven by dollar weakness, geopolitical tensions, and steady demand for safe-haven assets.

Today’s session reflected the classic consolidation phase after a powerful rally last week that pushed gold from $3,860 toward $3,970, reaching its highest levels since early 2025.

In this article, we’ll explore the daily overview of XAU/USD, interpret the attached charts (1H, 2H, 4H), and discuss the next move forecasts in light of the current global market conditions.

Daily Overview – What Happened in Gold (XAUUSD) Today :

Gold started today’s session around $3,945, facing mild selling pressure during the Asian hours as investors took partial profits following Monday’s surge. However, the yellow metal quickly regained momentum during the European session, bouncing from the $3,927–$3,930 support area, which aligns with the lower boundary of the intraday ascending channel.

By mid-London trading hours, buyers had pushed prices back toward $3,960, confirming that the bullish bias remains intact.

At the time of writing, gold is trading near $3,962, posting a modest daily gain of +0.25%.

The metal’s resilience above the $3,900 psychological support remains crucial. Every dip below $3,930 has been quickly bought, showing strong institutional demand amid global economic uncertainty.

Technical Analysis – XAUUSD Charts Breakdown :

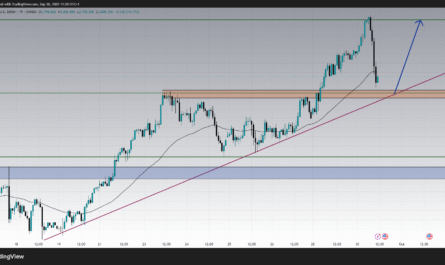

1-Hour Chart (Short-Term Momentum)

On the 1H chart, gold is clearly trading inside a rising parallel channel, with consistent higher highs and higher lows since late September.

After testing the upper band near $3,975, price retraced to the mid-channel and rebounded from $3,927, which also coincides with the 50-hour moving average (MA) and short-term trendline support.

-

Immediate Support: $3,927 – $3,930 zone

-

Key Resistance: $3,975 – $3,980 zone

-

Intraday Target: $4,000 psychological level

The MACD on this timeframe shows that bearish momentum is fading, as histogram bars contract near zero. A fresh bullish crossover could occur soon, which may trigger a new impulsive wave toward $3,980 and potentially $4,000.

Short-term traders will likely monitor the $3,927 level as the line between consolidation and continuation — holding above it supports a bullish continuation pattern.

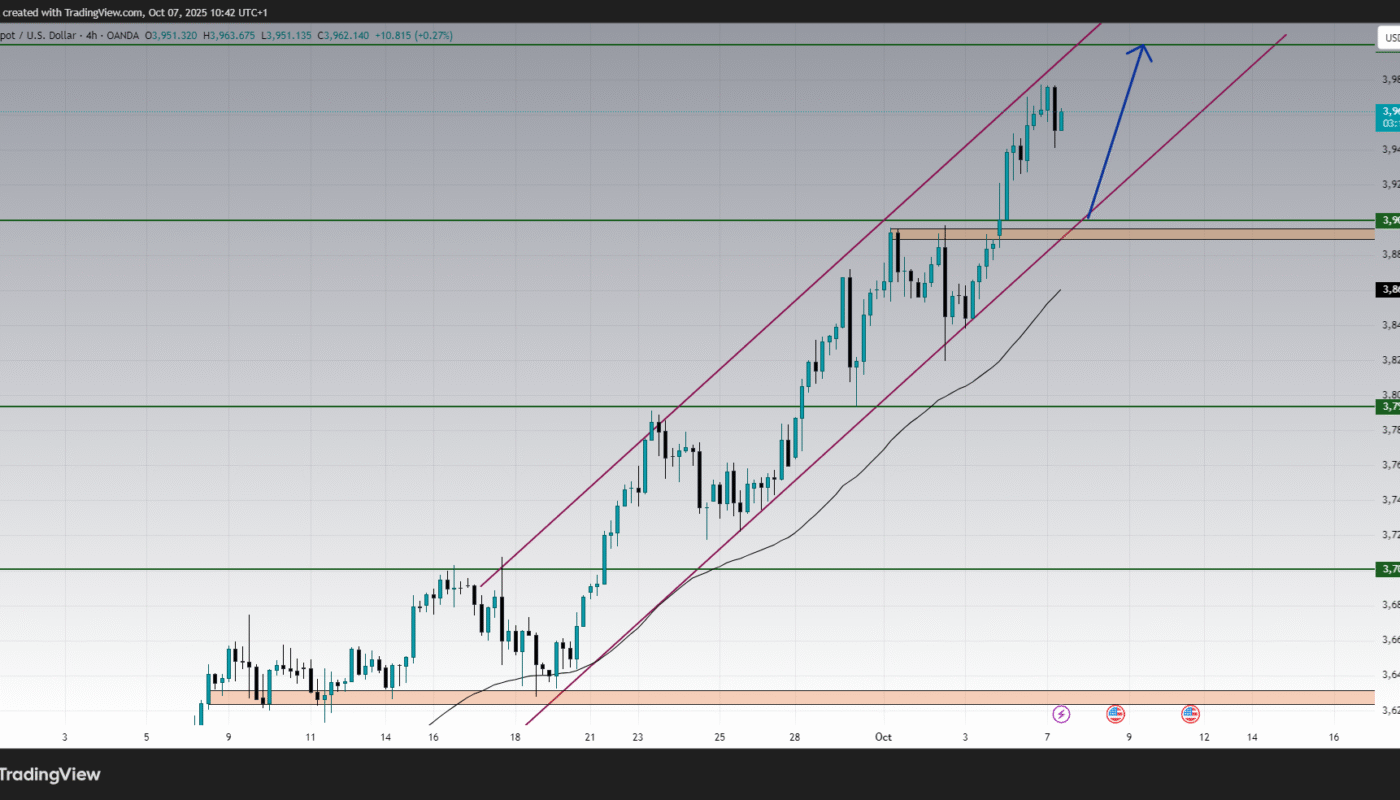

2-Hour Chart (Medium-Term Structure)

The 2H chart reinforces the same bullish narrative. Price action continues to respect the ascending channel, while moving averages remain aligned in bullish order (20 > 50).

The $3,900–$3,903 area stands out as a strong support cluster — it was previously resistance and has now turned into a demand zone.

The Stochastic oscillator recently completed a downward cycle into the oversold area (near 10–15), which historically precedes short-term bounces. This suggests that gold may resume upward movement in the next trading sessions.

If momentum follows through, a break above $3,975 could expose the $4,000 round-number level, where profit-taking might occur before the next leg higher.

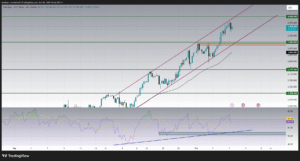

4-Hour Chart (Main Trend and Market Context)

The 4H timeframe provides a clearer picture of the broader trend.

Gold has been rising steadily since the September bottom near $3,700, gaining more than 7% in less than three weeks. The current leg shows an unbroken sequence of higher lows, proving that buyers remain in control.

Key technical observations:

-

Trend channel: Intact, with dynamic support aligning near $3,900.

-

Major support: $3,793 – the base of the last major correction.

-

Primary resistance: $4,000 – upper boundary of the ascending channel.

-

RSI: Currently at 67, showing strong momentum but not yet overbought.

The RSI trendline, drawn from the September lows, continues to act as support. As long as RSI stays above 55, the trend remains bullish.

If gold breaks above $3,980–$4,000, the next target could extend toward $4,050–$4,100, corresponding to the upper extension of the channel.

Fundamental Context – Why Gold Is Holding Strong :

Beyond technicals, today’s gold move is also shaped by several macroeconomic and fundamental drivers:

-

Weaker U.S. Dollar (DXY):

The dollar index eased below 102.50, helping gold stay elevated. Traders expect softer U.S. inflation data later this week, which could push the Federal Reserve closer to its first rate cut in 2026. -

Bond Yields Cooling Down:

U.S. 10-year yields dipped below 4.1%, reducing the opportunity cost of holding non-yielding assets like gold. This factor has consistently fueled demand in recent sessions. -

Geopolitical Uncertainty:

Ongoing geopolitical tensions in Eastern Europe and the Middle East continue to support safe-haven demand. Investors are hedging portfolios against volatility in both the equity and crypto markets. -

Institutional Accumulation:

Central banks and ETFs have been increasing their gold reserves, taking advantage of dips near $3,900. This structural buying provides long-term price stability. -

Equity Market Rotation:

As the NASDAQ and S&P 500 show signs of short-term exhaustion after strong rallies, part of that liquidity is shifting toward defensive assets such as gold.

XAUUSD Forecast – What’s Next for Gold ?

Bullish Scenario

If gold holds above $3,930 and continues respecting the trendline, expect buyers to challenge the $3,980–$4,000 resistance again.

A successful breakout could open the way toward $4,050, followed by $4,120, where the upper limit of the ascending channel currently sits.

In this scenario, momentum traders could favor pullback entries near $3,940–$3,950 with targets around $4,050+.

Bearish Scenario

If sellers manage to push XAU/USD below $3,900, the short-term bullish structure would weaken. In that case, gold could correct toward $3,860 and even $3,793, where stronger buying interest is expected.

However, given the underlying fundamentals, this downside scenario currently appears less likely unless the U.S. Dollar rebounds sharply or yields spike again.

Market Sentiment and Trader Positioning :

Market sentiment remains optimistic, with traders favoring buying dips rather than chasing rallies.

According to recent positioning data, speculative long positions have increased by more than 8% over the past week, showing renewed confidence in the precious metal’s ability to hold above $3,900.

Retail traders, however, remain cautious, expecting short-term corrections near $4,000 … a psychological barrier that historically attracts profit-taking.

The combination of bullish institutional flow and retail hesitation often precedes further upside, as the larger players tend to drive continuation moves once resistance is tested multiple times.

Conclusion :

Today’s session confirmed that gold remains in a strong uptrend, comfortably trading above $3,950. The recent pullback appears to be a normal consolidation within an ongoing bullish channel rather than a reversal.

As long as XAU/USD holds above $3,900, the outlook favors continued upside toward $4,000–$4,050, driven by weak U.S. yields, ongoing geopolitical risks, and steady institutional demand.

From both technical and fundamental perspectives, the path of least resistance for gold remains upward. Traders should monitor the $3,930 support and $4,000 resistance for confirmation of the next directional breakout.

One thought on “XAUUSD Next Move : Gold Forecast & Technical analysis today”

Comments are closed.