The EURUSD pair is trading near 1.1730, consolidating after a volatile week marked by mixed signals from U.S. economic data and cautious European sentiment. Traders are watching closely as the euro faces pressure from a stronger U.S. dollar, while technical indicators highlight a crucial battle between bulls and bears around support levels. In today’s analysis, we will review the technical setup, support and resistance zones, and fundamental drivers shaping the outlook for the world’s most traded currency pair.

Short-Term Outlook : 1H and 2H Charts

On the 1-hour chart, EURUSD is testing the 1.1720–1.1730 support zone, which has been acting as a decision point in recent sessions. Price has attempted several rebounds, but the repeated rejections at higher levels show that sellers are still in control. The RSI indicator is hovering around 46, pointing to weakening momentum, while bearish divergence (lower highs on RSI versus stable price action) warns of downside risks.

The 2-hour chart confirms this view, with the pair struggling to hold above the trendline that previously guided price action higher. The stochastic oscillator is pointing lower, suggesting continued weakness. If sellers break below the 1.1720 area, EURUSD could accelerate toward the next key support at 1.1645.

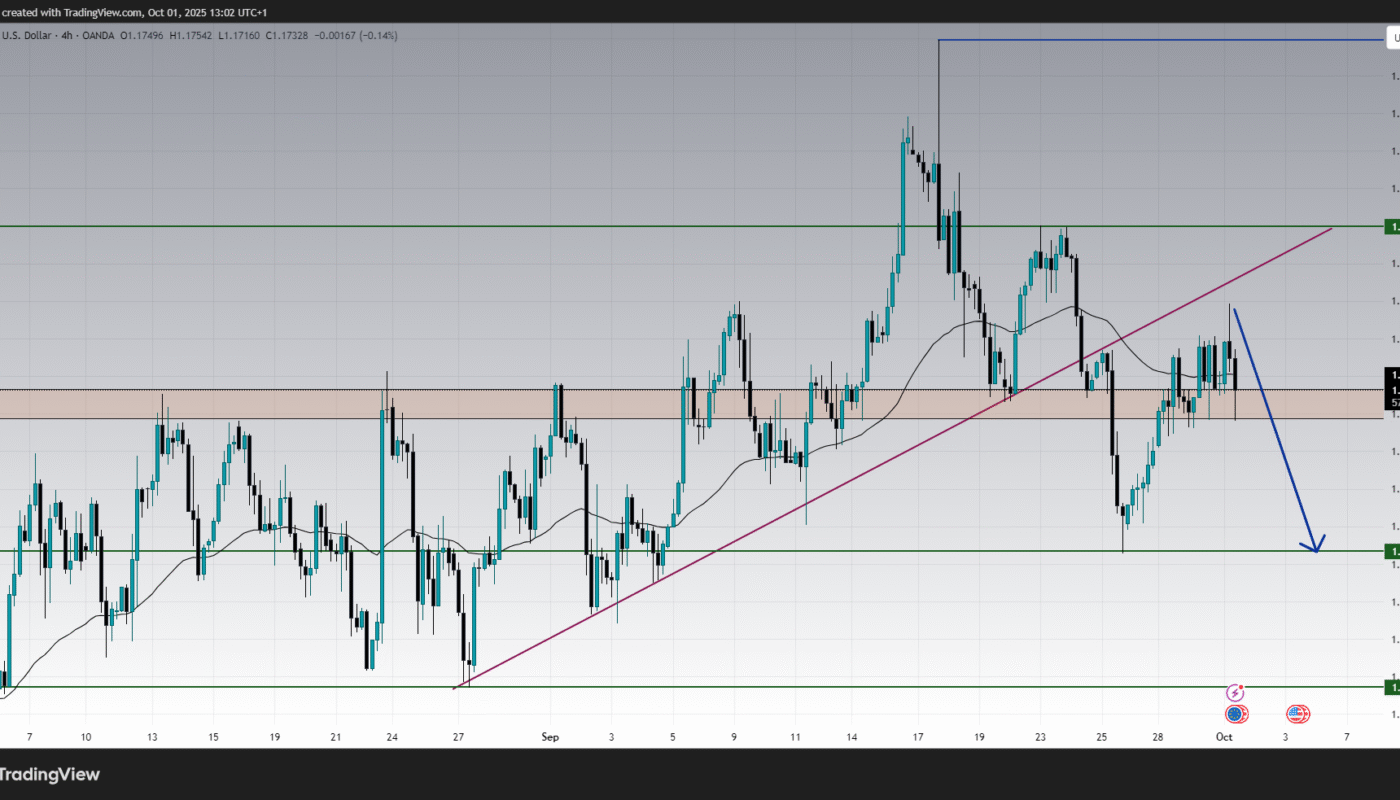

Medium-Term Technical View : 4H Chart

Looking at the 4-hour timeframe, EURUSD shows a broader consolidation between 1.1819 resistance and 1.1645 support. The recent failure to sustain gains above the 1.1760 zone highlights the strength of dollar buying interest. The MACD indicator is flat near the zero line, showing indecision, but the bias tilts bearish given the inability of buyers to push higher.

If the pair manages to reclaim 1.1760, bulls could attempt a recovery toward 1.1819. However, if the 1.1720 floor gives way, the market could quickly test 1.1645, and a deeper decline may even extend toward 1.1575.

Key Levels to Watch :

-

Immediate Resistance: 1.1760 – Key intraday level that needs to be broken for a bullish attempt.

-

Major Resistance: 1.1819 – A critical ceiling where sellers are expected to regroup.

-

Immediate Support: 1.1720 – A make-or-break level for short-term direction.

-

Secondary Support: 1.1645 – The next strong demand zone if 1.1720 fails.

-

Major Support: 1.1575 – A deeper bearish target if downside momentum accelerates.

Fundamental Drivers :

The euro-dollar exchange rate is also heavily influenced by macroeconomic and monetary policy developments:

-

U.S. Dollar Strength: Recent U.S. economic data, including stronger-than-expected consumer spending, has reinforced the view that the U.S. economy remains resilient. This has pushed the dollar higher against most majors.

-

Federal Reserve Outlook: Markets remain uncertain about whether the Fed will extend its pause on rate hikes or signal more tightening. Any hawkish commentary tends to support the dollar, pressuring EUR/USD.

-

European Data Weakness: The Eurozone economy continues to show slower growth, with Germany and France facing weak industrial performance. This undermines the euro’s recovery potential.

-

Geopolitical Risks: Energy prices and ongoing trade uncertainties in Europe add pressure to the common currency.

Together, these factors suggest that while technical rebounds are possible, the broader outlook for EUR/USD remains fragile unless the euro finds stronger fundamental support.

Scenario Outlook :

-

Bullish Scenario: If EURUSD holds above 1.1720 and regains 1.1760, a recovery toward 1.1819 could unfold. A break above 1.1820 would shift the short-term outlook back to bullish.

-

Bearish Scenario: If the pair breaks decisively below 1.1720, sellers may push toward 1.1645. Failure to defend this level would likely extend the downtrend toward 1.1575.

Traders should closely monitor U.S. economic releases this week, especially job market and inflation data, as they will directly influence the Fed’s next move and the direction of EUR/USD.

Conclusion :

The EURUSD pair is at a critical juncture, trading near 1.1730 with support at 1.1720 acting as a battleground for bulls and bears. As long as the pair holds above this level, there is potential for a bounce toward 1.1760–1.1819. However, if sellers break below 1.1720, the door opens for a decline toward 1.1645 and possibly 1.1575.

With technical indicators signaling weakness and fundamentals supporting the U.S. dollar, the best decision for traders is to stay cautious: look for confirmed signals around 1.1720 before committing to either direction. Short-term traders may prefer downside setups if support breaks, while longer-term investors should wait for stronger confirmation of trend reversal before positioning.

One thought on “EURUSD Technical Analysis Today : Market Forecasts and Signals”

Comments are closed.