The NASDAQ 100 Index (US100) Trading closed this week on a mixed note, consolidating near 24,770 points after a strong start earlier in the week. Despite brief corrections on Friday, the index remains within a medium-term bullish structure, supported by resilient tech earnings, moderate bond yields, and positive investor sentiment around AI-driven innovation.

Throughout the week, the tech-heavy NASDAQ 100 was influenced by sector rotations and mixed earnings updates. Giants like NVIDIA (NVDA), Apple (AAPL), and Microsoft (MSFT) contributed to the overall strength, while Meta (META) and Tesla (TSLA) showed short-term weakness, creating temporary volatility.

Let’s analyze how the market performed this week, what technical levels are key for traders, and what to expect in the coming week’s NASDAQ 100 forecast.

Weekly Overview – Market Performance and Sector Highlights :

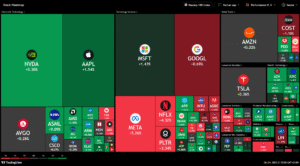

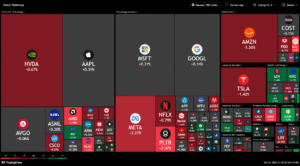

The NASDAQ heatmap shows a divided performance across the technology landscape.

In the first part of the week, semiconductor stocks led the rally … NVIDIA gained +5.3%, AMD +2.5%, and ASML surged over +9%. These moves reflected renewed optimism in AI chip demand, data center expansion, and positive manufacturing outlooks.

Apple (AAPL) rose +1.54% following strong pre-order demand for its latest devices, while Microsoft (MSFT) climbed +1.43%, supported by cloud revenue growth expectations.

However, by Friday’s close, the heatmap turned mixed:

-

NVIDIA gave back -0.67%,

-

Meta (META) dropped -2.27%,

-

Tesla (TSLA) fell -1.42%,

-

and Netflix (NFLX) lost -0.79%.

The weakness in mega-cap names came as investors locked in profits and repositioned portfolios before next week’s FOMC minutes and upcoming inflation data.

Healthcare and industrials sectors provided relative strength, with AstraZeneca (AZN) up +15.8% and Amgen (AMGN) +8.5%, showing diversification into defensive plays.

Technical Analysis – NASDAQ 100 (US100) :

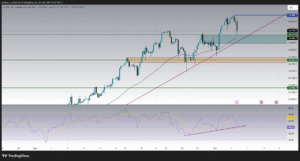

Short-Term View (1H & 2H Charts)

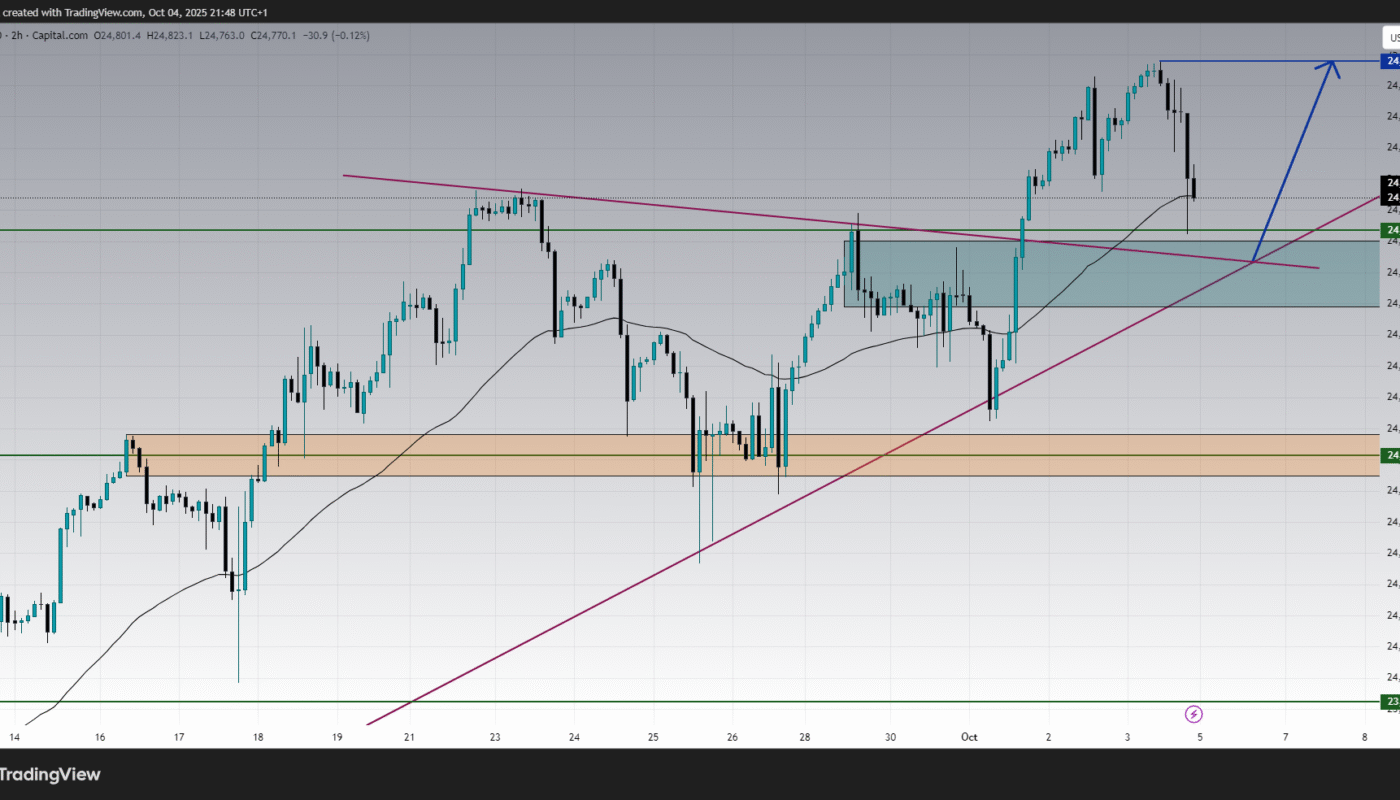

On the 1-hour and 2-hour charts, the NASDAQ 100 has been forming a healthy ascending channel, with price action respecting the 24,652–24,717 zone as near-term support.

This region coincides with both the rising trendline and the 50-period moving average, which have acted as dynamic areas of buyer interest.

-

Immediate support: 24,652 → 24,717 zone

-

Secondary support: 24,356 zone

-

Major support: 23,961 zone

The stochastic oscillator on the 1H chart is rebounding from oversold territory near 10, suggesting a potential short-term bounce early next week. If price holds above 24,650, momentum could drive a recovery toward 24,989, which marks the weekly resistance and recent swing high.

In the 2H timeframe, the MACD histogram shows bearish momentum fading, indicating that selling pressure is weakening. The bullish crossover could occur soon, signaling the next upward impulse toward 25,000, followed by 25,200 if momentum strengthens.

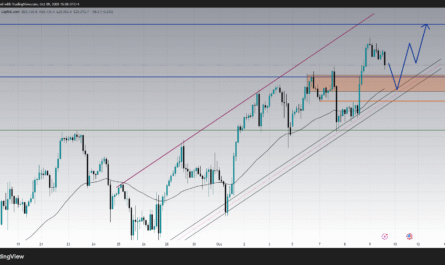

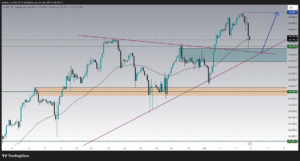

Medium-Term View (4H Chart)

On the 4-hour chart, the overall trend remains bullish, despite the recent retracement. The market continues to form higher highs and higher lows, respecting the ascending trendline that originated from the September lows near 23,900.

The RSI indicator is now consolidating around the 50–55 zone, confirming that the pullback is likely corrective rather than a trend reversal. As long as the RSI remains above 45 and the price stays above 24,650, bulls remain in control.

Key resistance levels to monitor:

-

24,989 – short-term resistance and local high.

-

25,200 – next bullish target if 24,989 breaks.

If the index rebounds from the support confluence zone (24,650–24,700), it could resume its upward trajectory toward 25,000, and possibly 25,250 in the medium term.

Weekly Technical Outlook :

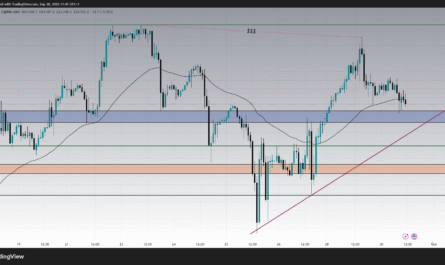

Zooming out to the daily and weekly context, NASDAQ 100 has been climbing since early September after bouncing from 23,600, forming a consistent bullish pattern supported by favorable macroeconomic data and a recovery in risk sentiment.

This week’s candle shows a long lower wick, indicating that buyers stepped in aggressively near the 24,700 region. The 20-day moving average continues to slope upward, confirming medium-term momentum remains positive.

-

Weekly structure: bullish above 24,356

-

Trendline support: 24,650

-

Major resistance: 25,000 → 25,250

-

Key downside invalidation: below 24,350

As long as the price stays above 24,356, the broader market structure remains bullish, with potential continuation toward the 25,000–25,200 range next week.

Fundamental and Macroeconomic Factors :

Several fundamental drivers influenced the NASDAQ 100 this week:

-

US Treasury Yields and Fed Expectations:

Yields slightly cooled as markets priced in a lower probability of additional Fed rate hikes in 2025. This shift boosted high-growth tech stocks, which are sensitive to interest rate expectations. -

AI and Semiconductor Momentum:

The AI sector continues to dominate investor sentiment. NVIDIA and AMD regained traction after last week’s profit-taking, reaffirming that semiconductors remain the backbone of NASDAQ’s growth narrative. -

Labor Market and Inflation Data:

Mixed US employment data caused temporary intraday volatility but ultimately supported risk assets as wage growth slowed … reducing inflation fears and reinforcing the soft-landing narrative. -

Earnings Season Outlook:

As Q4 approaches, traders are positioning for strong corporate earnings in tech and software, which could further propel NASDAQ toward all-time highs if guidance remains optimistic.

Heatmap Insight – Sector Rotation and Market Sentiment :

The heatmap comparison between early and late-week sessions highlights investor rotation.

Early gains were concentrated in semiconductors and software, but by Friday, traders shifted toward healthcare and defensive assets.

This rotation suggests profit-taking rather than panic selling … typical in strong uptrends before major data releases.

Notably:

-

NVIDIA (NVDA) and ASML remain leaders in bullish momentum.

-

Meta (META) and Tesla (TSLA) experienced short-term pullbacks, but remain above key support levels.

-

Microsoft (MSFT) and Apple (AAPL) continue to act as stabilizers, maintaining steady growth within the index.

Such mixed heatmaps typically precede short-term consolidation followed by continuation, aligning with our technical forecast for a rebound toward 25,000 next week.

NASDAQ and Crypto Correlation :

Interestingly, the correlation between NASDAQ 100 and major cryptocurrencies like Ethereum (ETHUSD) remains significant. The rebound seen in ETH this week, from around $3,900 to $4,500, mirrors the NASDAQ’s structure … both reflecting renewed risk appetite in global markets.

As long as macro conditions remain stable and the US Dollar shows mild weakness, growth assets both tech stocks and cryptocurrencies — are likely to trend higher together in the upcoming week.

NASDAQ 100 Forecast – Outlook for Next Week :

For the week ahead (October 7–11, 2025), the technical and fundamental landscape supports a bullish-to-neutral bias:

-

Bullish Scenario:

If NASDAQ holds above 24,650 and rebounds early in the week, we could see a retest of 24,989, followed by 25,200. A breakout above this level opens the door toward 25,400–25,500 in the medium term. -

Bearish Scenario:

A sustained drop below 24,350 would indicate a deeper correction toward 23,960, invalidating the current bullish structure. However, this scenario remains less likely unless major economic surprises hit the market. -

Neutral Scenario:

Consolidation between 24,650 and 25,000 could dominate the early part of the week, as traders await CPI data and Fed communications.

Conclusion :

The NASDAQ 100 (US100) remains in a constructive uptrend despite short-term pullbacks. This week’s profit-taking phase was healthy and expected after a multi-week rally. The market continues to find strong demand near 24,650, confirming that bulls are defending key zones ahead of next week’s fundamental catalysts.

With AI stocks, semiconductors, and large-cap tech continuing to drive the index, and with macro conditions supporting risk appetite, the path of least resistance remains upward.

Unless the index loses its 24,350 support decisively, traders can expect the NASDAQ 100 to target 25,000 and 25,200 next week, aligning with the broader bullish bias seen across risk assets — including cryptocurrencies.