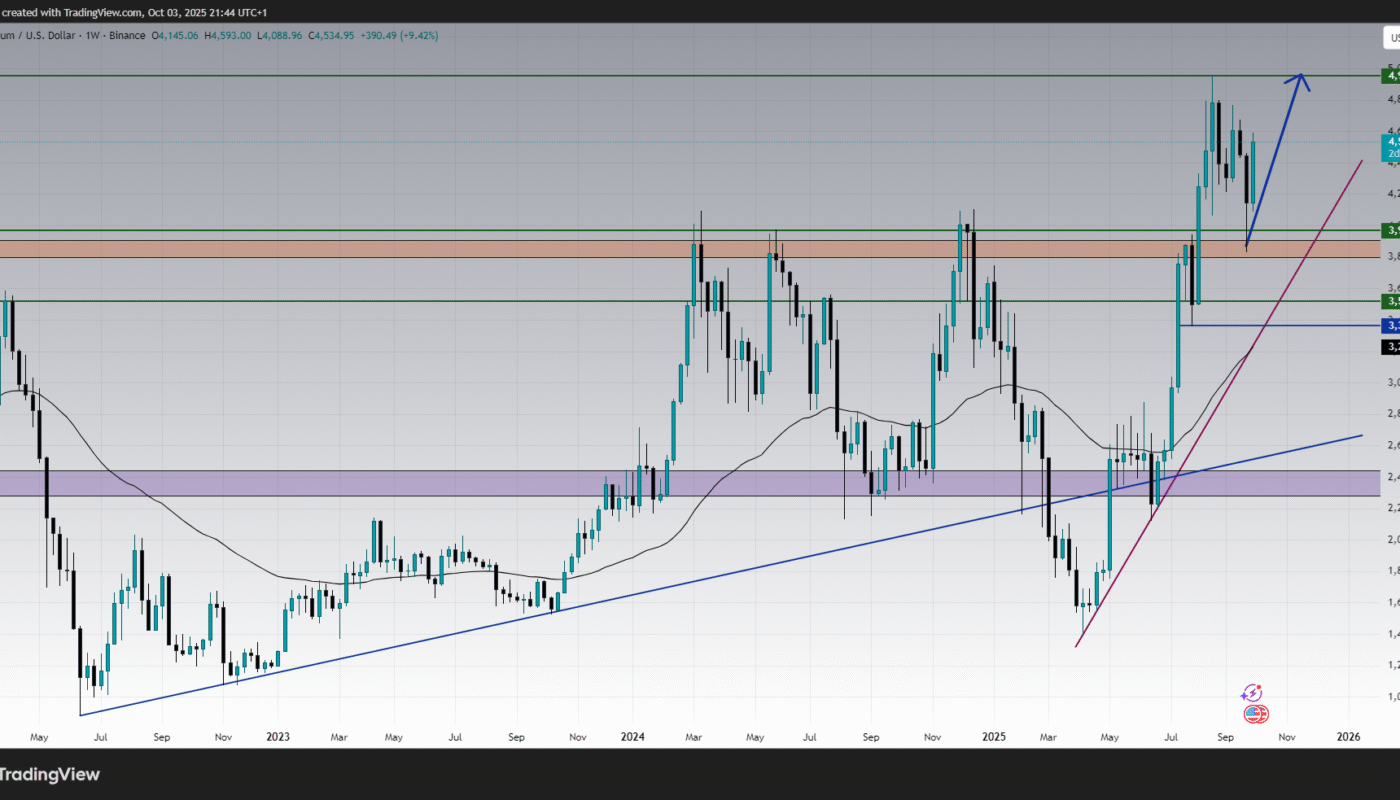

Ethereum (ETHUSD) has ended the week on a bullish note, climbing back above $4,500 and consolidating gains after a sharp recovery from the $3,900–$4,000 support zone. This rally has been supported by both technical and macroeconomic factors, as risk sentiment in global markets improves and investor appetite for cryptocurrencies strengthens.

The broader crypto market also posted gains, with Bitcoin approaching $120,000 and Ethereum riding the momentum of risk-on flows, institutional accumulation, and expectations of future network upgrades. This analysis provides a comprehensive weekly overview of ETH/USD price action, key support and resistance levels, fundamental drivers, and scenarios to watch in the coming week.

Weekly Overview : What Happened This Week

Ethereum started the week under pressure, trading near the $4,000 support zone after sellers tested the $3,968 level. This area acted as a major demand zone, where buyers consistently stepped in to defend long-term trendline support.

From there, ETH/USD staged a strong rebound, climbing more than 12% within the week. By mid-week, the price had cleared the $4,200 resistance, regaining the bullish channel and breaking above the 50-day moving average.

-

Weekly low: $3,968 (key support retest)

-

Weekly high: $4,593 (local resistance)

-

Current close: Around $4,534, showing strong weekly bullish momentum

This upward move restored confidence among traders who had been waiting for a decisive bounce. Importantly, the weekly candle closed well above the $4,287 resistance zone, turning it into a new support level.

Technical Analysis : Multi-Timeframe View

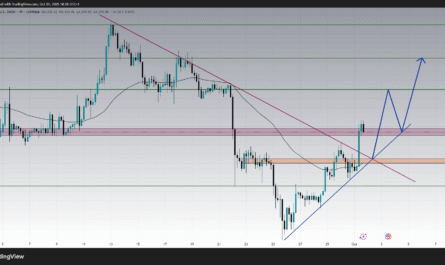

1. Short-Term View (4H Chart)

On the 4H chart, Ethereum has been trading in a rising channel since bouncing from $3,968. The uptrend is well-supported by an ascending trendline, currently aligning with the $4,287–$4,300 area.

-

Immediate resistance: $4,593, followed by $4,750

-

Immediate support: $4,287, then $3,968

-

Momentum: The stochastic oscillator shows a minor cooldown from overbought conditions, suggesting short-term pullbacks are possible.

The short-term setup favors dips as potential buying opportunities, as long as ETH/USD holds above $4,287.

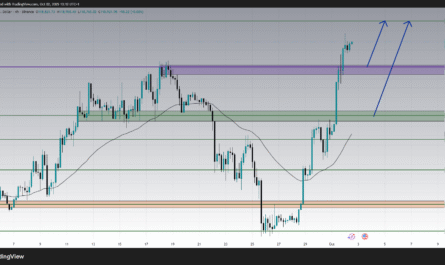

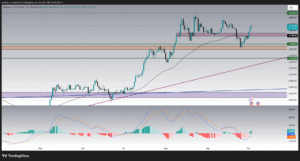

2. Medium-Term View (Daily Chart)

The daily chart confirms the breakout strength. ETH has reclaimed the 50-day moving average and closed multiple sessions above $4,500, signaling that buyers are firmly in control.

The MACD histogram has flipped positive, and the signal lines are crossing upward, reinforcing bullish momentum.

-

Key resistance: $4,750 (intermediate) and $4,954 (major weekly target)

-

Key support: $4,287 (structural), followed by $3,968 (major demand zone)

As long as Ethereum remains above $4,287 on a daily closing basis, the path of least resistance remains upward.

3. Long-Term View (Weekly Chart)

The weekly chart paints a clear bullish picture. ETH/USD broke out of a multi-month consolidation between $3,500 and $4,200, and the rebound from $3,968 this week confirmed the strength of trendline support dating back to early 2024.

The RSI remains comfortably above 60, showing that momentum is still in bullish territory without being overextended.

-

Major resistance: $4,954 (weekly top) – a break above this could open the way to $5,200 and $5,500 in the coming weeks.

-

Major support: $3,968 – the weekly demand base that buyers must defend.

This long-term structure strongly favors bullish continuation, provided macroeconomic conditions remain supportive.

Fundamental Drivers Behind Ethereum’s Move :

Ethereum’s bullish recovery this week wasn’t just technical—it was supported by important fundamental drivers that shaped broader market sentiment.

-

Crypto Market Recovery: Bitcoin’s rally toward $120,000 brought fresh inflows into Ethereum, as investors diversified across major altcoins.

-

Ethereum Network Upgrades: Ongoing developments around ETH scalability, staking participation, and Layer-2 adoption continue to improve investor confidence.

-

Macro Sentiment: A softer U.S. dollar and volatile Treasury yields have made risk assets like crypto more attractive. Any dovish hints from the Federal Reserve in upcoming meetings will support Ethereum further.

-

Institutional Flows: Reports show increasing Ethereum exposure in institutional crypto funds. This accumulation reinforces the case for medium- to long-term bullish momentum.

-

On-Chain Metrics: ETH supply on exchanges has decreased, reflecting accumulation by long-term holders, which often precedes further upside.

Key Levels to Watch :

-

Immediate Resistance: $4,593 – current weekly high

-

Secondary Resistance: $4,750 – a breakout level for acceleration

-

Major Resistance: $4,954 – if broken, ETH may aim for $5,200

-

Immediate Support: $4,287 – newly established support after breakout

-

Secondary Support: $3,968 – critical demand zone

-

Major Support: $3,518 – longer-term bullish invalidation level

Bullish and Bearish Scenarios for Next Week :

Bullish Scenario

If ETH/USD holds above $4,287 and builds momentum, the next upside test will be the $4,593–$4,750 resistance zone. A strong breakout above this area would likely lead to a test of $4,954, the major weekly resistance.

If buyers push through $4,954 with strong volume, Ethereum could target $5,200–$5,500 in the medium term. This scenario aligns with the broader bullish sentiment in crypto ETHUSD news headlines.

Bearish Scenario

On the downside, failure to hold above $4,287 could trigger a pullback toward the $3,968 demand zone. A daily close below $3,968 would weaken the bullish structure and expose ETH to deeper retracements toward $3,600 or even $3,500.

However, as long as $3,968 holds, dips are likely to be bought, making this a key level to monitor next week.

Weekly Outlook and Expectation for Next Week :

Looking ahead, Ethereum is well-positioned for further gains, with bullish momentum supported by both technical and fundamental factors. The $4,287 level now acts as a strong base for buyers, while $4,954 remains the major hurdle before new highs.

The upcoming week will focus on:

-

U.S. macroeconomic data (inflation, jobs report) impacting the dollar and crypto risk appetite.

-

Crypto market correlation with Bitcoin’s push toward $120,000.

-

Ethereum’s own network metrics and staking participation rates.

If risk appetite remains strong and Ethereum holds above $4,287, the bullish case toward $4,750 and $4,954 looks highly probable. Only a break below $3,968 would challenge this outlook.

Conclusion :

Ethereum (ETH/USD) delivered a strong weekly rebound, defending the $3,968 support zone and closing near $4,534. Technicals across multiple timeframes point to sustained bullish momentum, while fundamentals such as institutional inflows, network upgrades, and macroeconomic conditions continue to favor upside.

-

Holding above $4,287 keeps the bullish trend intact.

-

Upside targets stand at $4,593, $4,750, and ultimately $4,954.

-

Downside risk is limited as long as $3,968 holds.

In summary, the latest crypto ETHUSD news reflects a market that is regaining strength and positioning for a potential breakout. Traders should watch for pullbacks into support as buying opportunities, while medium-term investors may see Ethereum as increasingly well-positioned for a test of $5,000 and beyond.