Gold (XAUUSD) is currently trading around $3,884, moving once again toward the $3,900 psychological resistance level. The metal remains firmly within its bullish channel, supported by strong upward momentum and safe-haven demand. The price is trading comfortably above its 50-period moving average and the ascending trendline, reinforcing the broader bullish bias.

However, short-term indicators show signs of overbought conditions, suggesting that profit-taking or minor pullbacks are still possible before a decisive breakout. In this update, we review the technical setup, economic drivers, and trading scenarios to watch as Gold approaches new historical levels.

Short-Term Technical View : 1H and 2H Charts

On the 1-hour chart, Gold bounced from the $3,859 support and is now retesting $3,884 with upward momentum. The RSI has formed a triangle structure, with both resistance and support converging, signaling a potential breakout move in either direction. As long as price action holds above $3,859, the short-term bullish outlook remains valid.

On the 2-hour chart, Gold continues to respect the rising trendline while consolidating just below the $3,900 barrier. The MACD histogram shows fading bearish momentum, indicating that buyers are regaining control after the last correction. Key support is found at $3,845–$3,859, while resistance remains at $3,900.

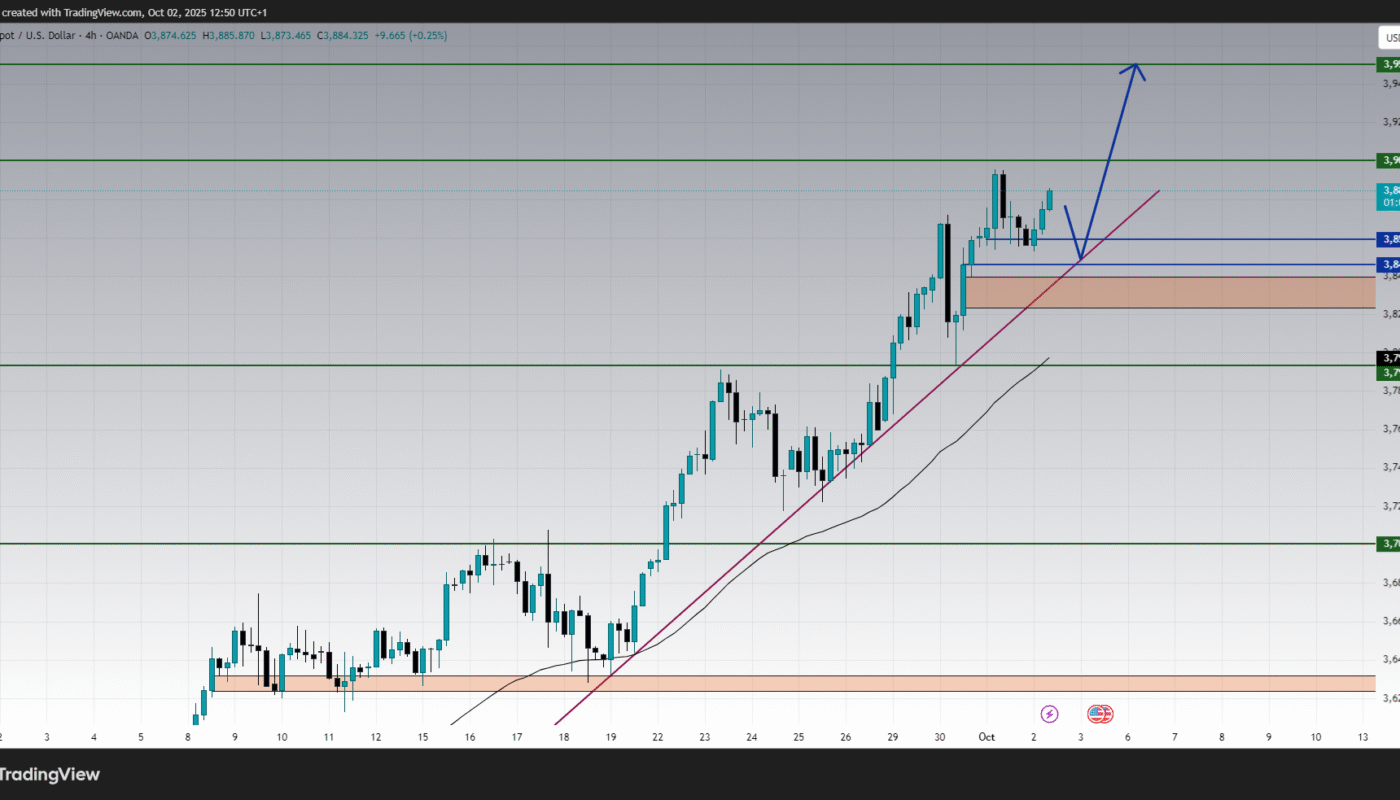

Medium-Term Technical View : 4H Chart

The 4-hour timeframe reinforces the bullish trend. Gold has been climbing steadily from the $3,700 area, creating higher highs and higher lows. Momentum oscillators show slight overbought signals, but no major reversal patterns have formed.

The structure suggests that even if Gold retraces toward $3,859–$3,845, buyers are likely to step in aggressively to defend the uptrend. Above $3,900, the next bullish target stands at $3,950, followed by the $4,000 psychological round level.

Key Levels to Watch :

-

Immediate Resistance: $3,900 – psychological and technical barrier.

-

Major Resistance: $3,950 – next bullish target if $3,900 is broken.

-

Immediate Support: $3,859 – aligned with the moving averages and trendline.

-

Secondary Support: $3,845 – zone to monitor during pullbacks.

-

Major Support: $3,793 – the foundation of the ongoing rally.

Economic and Fundamental Drivers :

Gold’s current move is shaped not only by technical momentum but also by macroeconomic factors:

-

U.S. Dollar Weakness: The dollar index has shown renewed softness as traders price in a potential Federal Reserve policy pause, boosting Gold demand.

-

Treasury Yields: While yields remain volatile, their inability to rise sharply has given Gold room to rally.

-

Inflation Outlook: Softer inflation trends and growing concerns about global growth slowdown continue to fuel safe-haven flows into Gold.

-

Geopolitical Risks: Persistent geopolitical uncertainties have kept Gold attractive for investors seeking protection.

Together, these factors create an environment where Gold’s bullish trend is supported by fundamentals, not just technicals.

Scenario Outlook :

-

Bullish Scenario: If Gold breaks above $3,900 with strong volume, buyers could extend the rally toward $3,950 and possibly test the $4,000 milestone in the coming sessions.

-

Bearish Scenario: If Gold fails to hold above $3,859–$3,845, a short-term correction toward $3,793 is possible. A decisive break below $3,793 would challenge the broader bullish structure.

Conclusion :

Gold (XAUUSD) remains in a strong uptrend, approaching the critical $3,900 resistance with momentum on its side. While indicators point to temporary overbought conditions, the broader bullish picture remains intact as long as price holds above $3,859–$3,845.

With macroeconomic fundamentals favoring safe-haven demand and technicals reinforcing higher targets, the path of least resistance remains upward. Traders should monitor $3,859 as a key support and watch for a potential breakout above $3,900, which could open the door toward $3,950 and beyond.