The British Pound (GBPUSD) is currently trading near 1.3470, consolidating after its recent recovery rally from the 1.3320 lows. The pair has found support from improving market sentiment and a weaker U.S. dollar, but upside momentum is being challenged by strong resistance in the 1.3500–1.3520 zone.

Sterling is still trending above its 50-period moving average on intraday charts, while short-term ascending trendlines confirm a bullish corrective structure. However, oscillators reveal signs of momentum fatigue, and the broader economic backdrop remains uncertain with both the Bank of England (BoE) and Federal Reserve (Fed) policy outlooks in focus.

This analysis will cover the short- and medium-term technical view, outline key support and resistance levels, and examine economic fundamentals that could drive GBP/USD in the coming sessions.

Short-Term Technical View : 1H and 2H Charts

On the 1-hour chart, GBPUSD continues to hold above its ascending trendline support, now sitting near 1.3453, which coincides with the 50-hour moving average. A dip toward this level could act as the first test for buyers to defend the recent bullish bias. Immediate resistance is found at 1.3500–1.3520, where recent price action has stalled after strong upward momentum.

The Relative Strength Index (RSI) on the 1H chart shows a bearish divergence, with price making higher highs while the oscillator prints lower highs. This signals fading momentum and raises the risk of a corrective pullback before the next bullish attempt.

On the 2-hour chart, the structure remains constructive, with the pair holding above both the moving average and the trendline. However, the MACD histogram shows momentum cooling, with a possible bearish crossover emerging. This suggests near-term consolidation, with risks tilted toward a test of support at 1.3453–1.3468 before any renewed push higher.

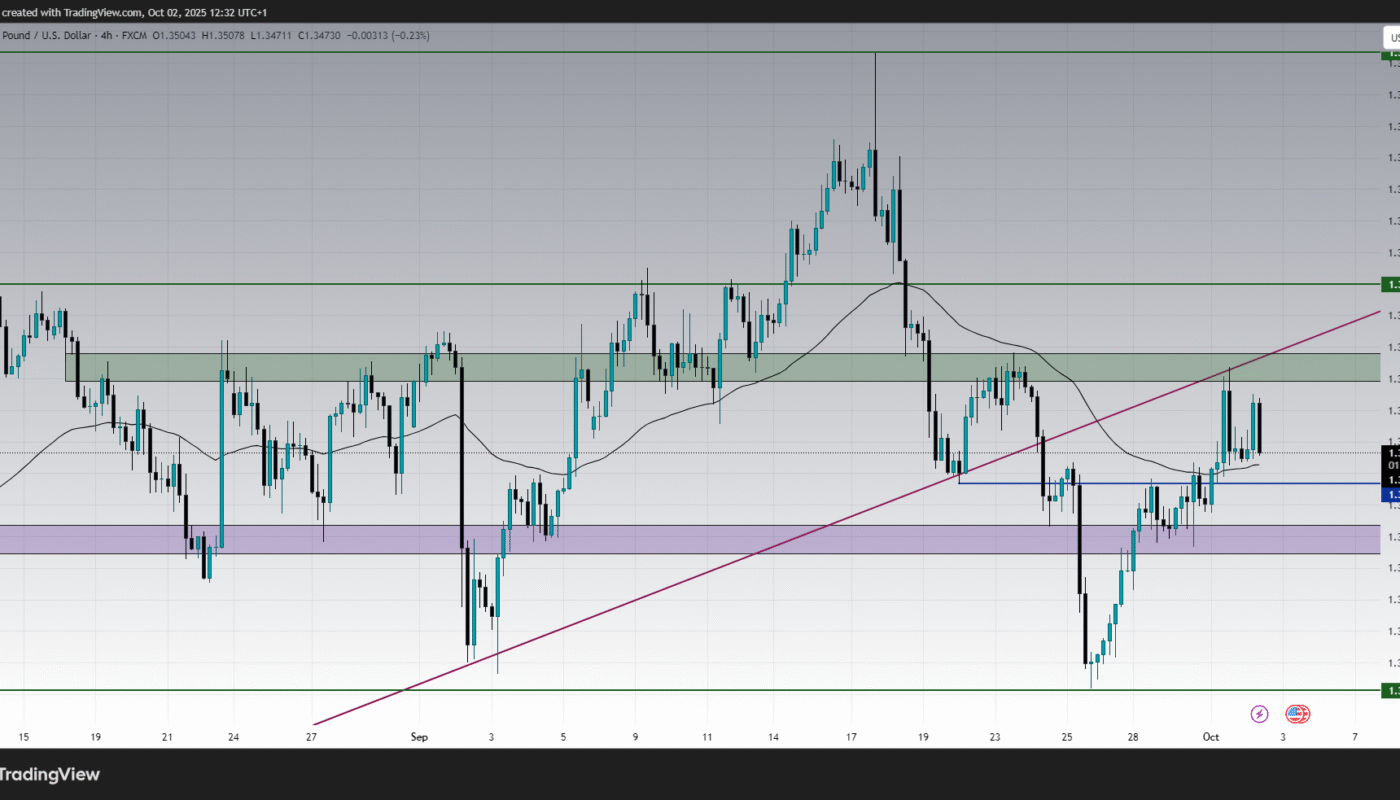

Medium-Term Technical View : 4H Chart

The 4-hour timeframe confirms the broader corrective uptrend from late September’s lows at 1.3322. The pair has retraced sharply higher, but gains are currently capped by the 1.3500–1.3520 resistance area, aligning with a previous supply zone.

The RSI remains neutral around the 50–55 range, reflecting consolidation after the recent rally. The stochastic oscillator also points downward, hinting at short-term weakness. Nonetheless, as long as GBP/USD stays above the purple demand zone near 1.3400–1.3420, the outlook remains constructive.

Further resistance lies at 1.3579, a key medium-term level that could open the door to a broader recovery if broken decisively. On the downside, a break below 1.3450 would expose the 1.3400 demand area, while a deeper decline could revisit the 1.3320 major support, the foundation of the current rebound.

Key Levels to Watch :

-

Immediate Resistance: 1.3500–1.3520 – Current barrier stalling upside momentum.

-

Major Resistance: 1.3579 – Next bullish target, decisive breakout would strengthen Sterling.

-

Immediate Support: 1.3453 – Short-term level aligned with moving averages.

-

Secondary Support: 1.3400–1.3420 – Key demand zone protecting the rally.

-

Major Support: 1.3320 – Base of recent rebound, critical to preserve bullish bias.

Economic and Fundamental Drivers :

The GBPUSD outlook is not only shaped by technical levels but also by a sensitive fundamental backdrop:

-

Bank of England Outlook: Markets remain divided on whether the BoE will maintain its restrictive stance amid slowing U.K. growth. Sticky inflation and wage pressures support hawkish caution, but weak consumer confidence and business surveys highlight economic fragility.

-

Federal Reserve Policy: The Fed’s uncertain path is driving dollar volatility. Investors speculate whether policymakers will keep rates steady or signal further tightening if inflation pressures persist. A dovish Fed would weaken the dollar and support Sterling, while hawkish surprises could cap GBP/USD gains.

-

U.K. Economic Data: Recent GDP and retail sales figures suggest a modest recovery, but risks of stagnation remain. Any downside surprises in upcoming economic releases could weigh on Sterling sentiment.

-

Global Risk Sentiment: The Pound is also sensitive to broader market risk appetite. Recent improvements in equity markets have supported GBP/USD, but renewed risk-off flows could strengthen the dollar and pressure Sterling lower.

Scenario Outlook :

-

Bullish Scenario: A sustained break above 1.3520 would target the 1.3579 resistance, with potential extension toward 1.3650 in the medium term. This would confirm stronger bullish momentum and open the way for a more prolonged recovery phase.

-

Bearish Scenario: Failure to hold above 1.3453–1.3468 could trigger a pullback toward 1.3400, with risk of further declines to 1.3320. A decisive break below 1.3320 would negate the bullish structure and reintroduce bearish pressure on Sterling.

For traders, the optimal strategy may be to monitor pullbacks toward support zones as potential entry levels, while keeping a cautious eye on the resistance at 1.3520.

Conclusion :

GBP/USD is consolidating near 1.3470, with bulls attempting to push higher but facing a critical resistance barrier at 1.3500–1.3520. While technical indicators suggest momentum is fading, the pair remains supported above key moving averages and trendlines, maintaining a constructive bias.

The broader economic context including the BoE’s policy outlook, Fed uncertainty, and global risk sentiment will play a decisive role in the next move. Holding above 1.3450–1.3420 keeps the bullish structure intact, with upside targets at 1.3520 and 1.3579. Conversely, a break below 1.3400 would expose the rally to deeper correction risks.

For now, Sterling traders should prepare for consolidation, but the long-term outlook remains cautiously optimistic as GBPUSD navigates a complex mix of technical barriers and macroeconomic drivers.