Ethereum (ETHUSD) is trading around $4,295, having broken through the critical $4,280 resistance level for the first time in recent weeks. The breakout was supported by strong bullish momentum, sustained trading above the 50-period simple moving average (SMA), and price action trending firmly along a rising support line. This confirms the dominance of buyers in the short-term structure.

However, with momentum indicators now showing early signs of overbought conditions, Ethereum could face temporary consolidation before resuming its rally. In this analysis, we review the short-term technical setup, the medium-term structure, and the key economic and crypto market drivers that are shaping ETHUSD’s next move.

Short-Term Technical View : 1H and 2H Charts

On the 1-hour chart, Ethereum has established a bullish breakout above $4,280, turning this zone into immediate support. The price is currently consolidating near $4,295 – $4,330, suggesting that buyers are taking a pause after the strong push higher.

-

Immediate support: $4,196 – $4,175

-

Stronger support: $4,062, aligned with the rising trendline

The stochastic oscillator indicates cooling momentum after entering overbought territory, a sign that ETH could retest support zones before resuming its upward movement.

On the 2-hour chart, the bullish structure remains intact with higher highs and higher lows. The MACD histogram is still positive, though flattening slightly, which reinforces the idea of short-term consolidation before another push toward higher resistance levels.

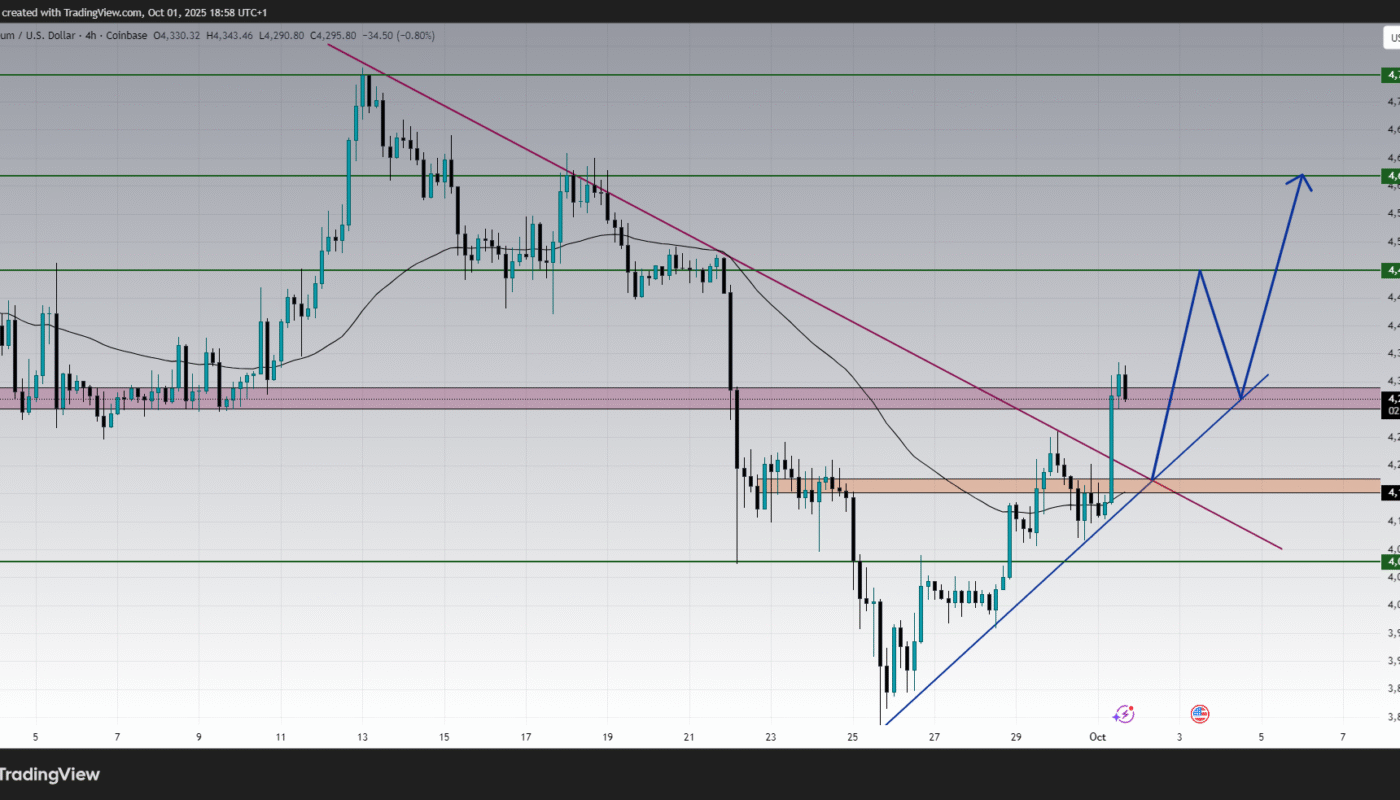

Medium-Term Technical View : 4H Chart

The 4-hour timeframe confirms the broader bullish bias. Ethereum has been climbing steadily from its recent swing low near $4,000, establishing a strong uptrend. The RSI is currently holding above 65, reflecting strong buying pressure, though also highlighting overbought risks.

-

Key resistance: $4,480 as the next bullish target

-

Extended resistance: $4,613 and $4,759 on continuation

-

Major support: $4,062 remains the critical line in case of deeper pullbacks

As long as Ethereum trades above $4,175 – $4,062, the medium-term uptrend remains solid.

Key Levels to Watch :

-

Immediate Resistance: $4,480 – next bullish target

-

Major Resistance: $4,613 and $4,759 – medium-term objectives if momentum continues

-

Immediate Support: $4,196 – $4,175 – breakout zone to watch closely

-

Secondary Support: $4,062 – trendline and demand area

-

Major Support: $4,000 – psychological level and key demand

Economic and Fundamental Drivers :

Ethereum’s latest rally is not just technical; it is supported by broader crypto and macroeconomic conditions:

-

Bitcoin Correlation: BTC’s strength above $65K has helped lift altcoins, with ETH following the bullish sentiment.

-

Institutional Adoption: Increased activity in Ethereum-based ETFs and staking protocols is fueling demand.

-

Macro Drivers: A softer U.S. dollar and stable bond yields have boosted risk assets, including cryptocurrencies.

-

Fed Policy Outlook: Market expectations for the Federal Reserve to maintain a dovish stance on rates support crypto as an alternative investment.

-

Network Activity: Rising Ethereum network transactions and renewed interest in DeFi protocols are adding a fundamental layer to the bullish move.

These factors align with Ethereum’s technical breakout, reinforcing the bullish case if resistance levels are cleared.

Scenario Outlook :

-

Bullish Scenario: If ETH holds above $4,280 – $4,175, momentum could drive prices toward $4,480, with further potential toward $4,613 and $4,759 in the medium term.

-

Bearish Scenario: Failure to sustain above $4,175 could lead to a corrective pullback toward $4,062. Only a decisive break below $4,062 would weaken the current bullish structure.

Conclusion :

Ethereum (ETHUSD) has broken above $4,280, confirming strong bullish momentum in the short-term trend. While overbought indicators suggest the possibility of minor pullbacks, the broader bias remains bullish as long as ETH trades above $4,175 – $4,062.

With both technicals and fundamentals aligned in Ethereum’s favor, the path of least resistance remains upward. Traders should monitor pullbacks as potential entry opportunities rather than chasing extended moves.