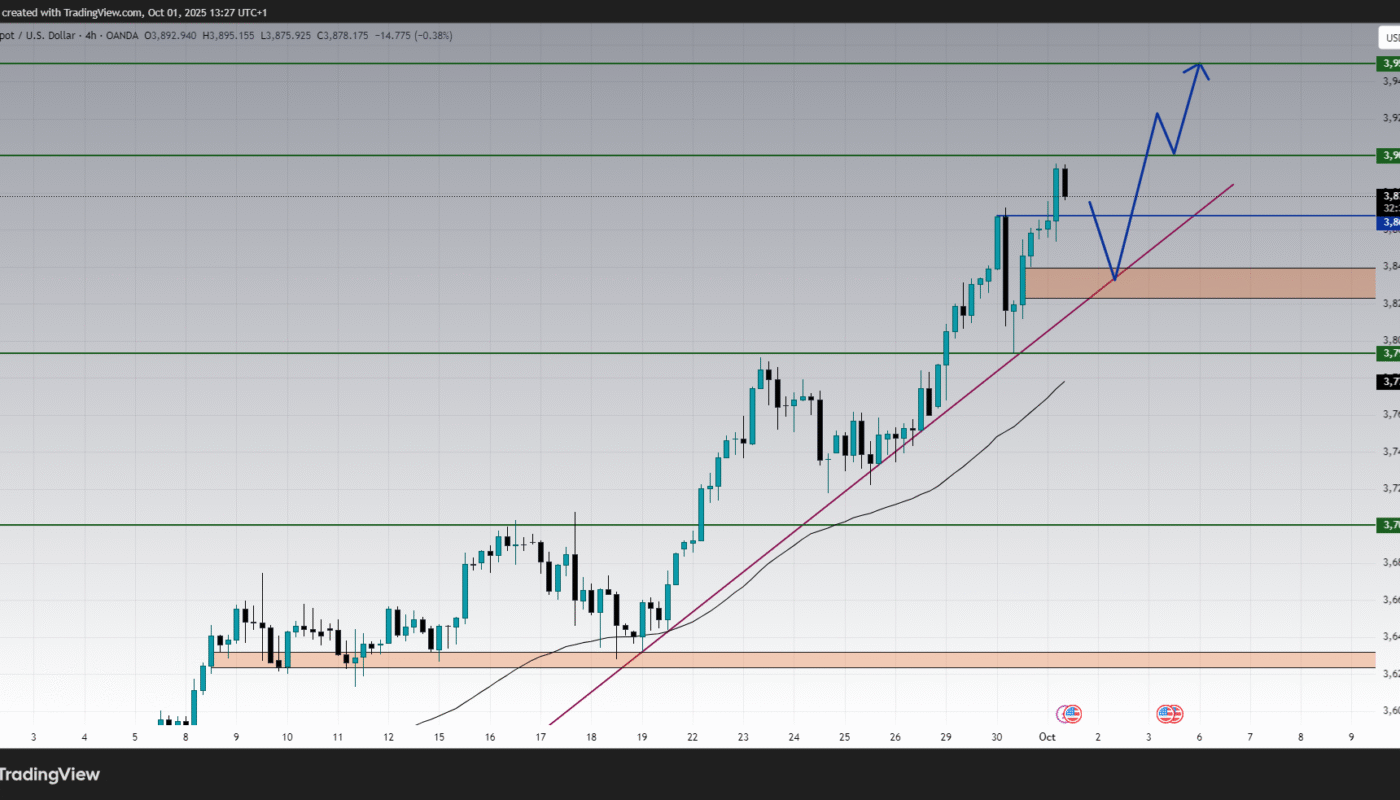

Gold (XAUUSD) is trading near $3,878, just shy of the $3,900 psychological resistance level. This is the first time in history that Gold has approached this barrier on short-term charts, supported by strong bullish momentum and continued safe-haven demand. The price is trending firmly above its 50-period moving average and respecting the ascending trendline, confirming the dominance of the short-term uptrend.

However, despite the strength, momentum indicators show overbought signals that could limit immediate gains. In this analysis, we break down the technical setup, support and resistance levels, and economic drivers, and provide possible trading scenarios for the coming sessions.

Short-Term Technical View : 1H and 2H Charts

On the 1-hour chart, Gold continues to ride the bullish wave, supported by the rising trendline from last week. Price action recently tested $3,891 before pulling slightly lower, showing signs of temporary profit-taking. Immediate support is now seen at $3,859, aligned with the moving average, while deeper support lies at $3,844–3,845.

The stochastic oscillator shows momentum cooling from overbought conditions, indicating that buyers may pause before attempting another push higher. This suggests a possible pullback toward support before resuming the uptrend.

On the 2-hour chart, the structure is similar: higher highs and higher lows remain intact. The MACD histogram remains positive, but momentum is flattening, reinforcing the possibility of consolidation before another leg upward.

Medium-Term Technical View : 4H Chart

The 4-hour timeframe confirms the bullish outlook. Gold has been climbing steadily since bouncing from $3,700, making consistent gains toward $3,900. The RSI indicator is hovering near 68, reflecting strong momentum but also warning of overbought conditions. Historically, such levels have preceded minor corrections before continuation.

Key resistance stands at $3,900, followed by $3,950, while the $3,793 zone is the nearest strong demand area if price retraces. As long as Gold remains above $3,793, the broader uptrend remains intact.

Key Levels to Watch :

-

Immediate Resistance: $3,900 – Psychological and technical barrier.

-

Major Resistance: $3,950 – Next bullish target if $3,900 is cleared.

-

Immediate Support: $3,859 – Short-term level aligned with moving averages.

-

Secondary Support: $3,844 – Important zone to monitor during pullbacks.

-

Major Support: $3,793 – The foundation of the latest rally; must hold to preserve bullish bias.

Economic and Fundamental Drivers :

Gold’s rally is not only technical—it is strongly backed by macroeconomic fundamentals:

-

U.S. Dollar and Yields: The U.S. dollar index has shown signs of cooling, while Treasury yields remain volatile. A weaker dollar typically supports Gold prices.

-

Federal Reserve Outlook: Markets continue to speculate on whether the Fed will maintain its pause on interest rate hikes. If policymakers adopt a dovish tone, Gold could benefit further.

-

Inflation and Economic Data: Softer inflation readings in the U.S. and weaker growth outlooks globally have increased safe-haven demand.

-

Geopolitical Risks: Rising geopolitical uncertainties and concerns over global economic stability are pushing investors into safe-haven assets like Gold.

These drivers align with the current bullish trend, reinforcing the case for higher Gold prices if technical resistance levels are broken.

Scenario Outlook :

-

Bullish Scenario: If Gold breaks above $3,900 with strong volume, the next target becomes $3,950, followed by the potential to extend toward the $4,000 round level in the medium term.

-

Bearish Scenario: If Gold fails to hold above $3,859–3,844, short-term profit-taking could drag prices back toward $3,793. Only a decisive break below $3,793 would weaken the broader bullish structure.

For traders, the best strategy is to monitor pullbacks as potential entry zones, rather than chasing the breakout. As long as the uptrend remains intact, dips toward $3,850–3,845 could provide buying opportunities with targets toward $3,900 and $3,950.

Conclusion :

Gold (XAUUSD) is approaching a historic resistance at $3,900, supported by strong bullish momentum and favorable macroeconomic conditions. While short-term indicators suggest overbought conditions that may trigger a pullback, the broader trend remains positive. Holding above $3,859–3,844 keeps the bullish bias intact, with upside targets at $3,900 and $3,950.

With safe-haven demand still driving the market and fundamentals aligning in Gold’s favor, the path of least resistance remains upward. Traders should prepare for possible pullbacks, but the long-term bullish case remains strong as the precious metal eyes new record highs.