XAUUSD remains in the spotlight as prices extend their strong bullish trend, pushing toward the $3,867 resistance level after a solid rally in recent sessions. The precious metal has benefited from renewed safe-haven demand, with investors positioning ahead of upcoming U.S. economic data and ongoing uncertainty around global monetary policy. In today’s analysis, we will highlight the most important support and resistance levels, technical indicators, and potential trading scenarios for Gold as the market heads into a decisive phase.

Short-Term Outlook : 1H and 2H Charts

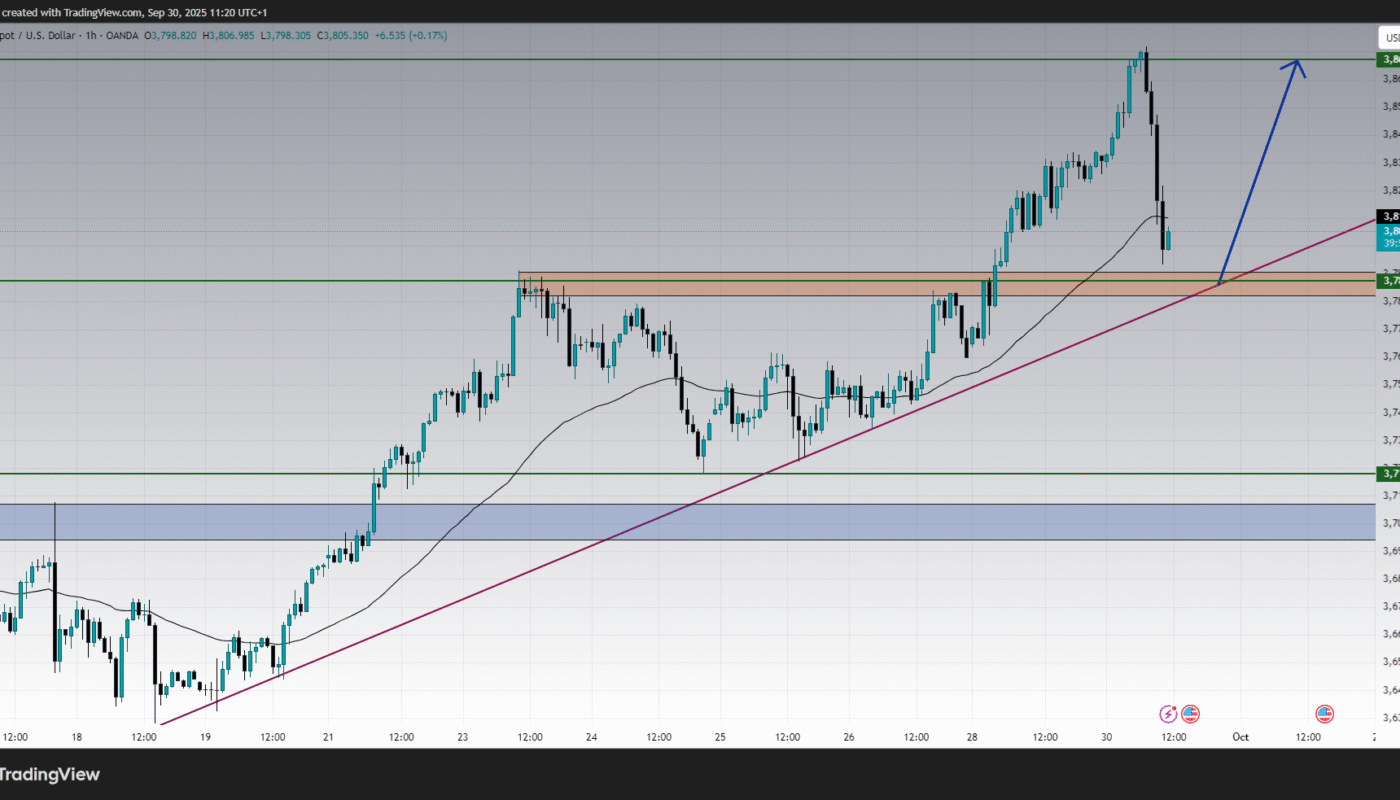

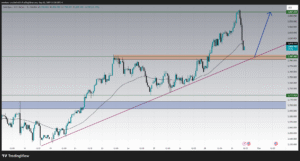

On the 1-hour chart, Gold recently broke above the $3,787 resistance, accelerating toward the $3,860–$3,867 area before sellers appeared. The current pullback is testing the rising trendline and the support zone around $3,786–$3,805. As long as price action holds above this region, the bullish outlook remains intact.

The 2-hour chart paints a similar picture. The breakout from $3,717 sparked strong momentum, with buyers pushing higher until overbought conditions forced a correction. The RSI indicator, which recently crossed above 67, is now cooling toward 49, suggesting that the retracement is more of a technical reset than a reversal.

Key takeaway: as long as XAU/USD remains above $3,786, buyers could re-enter the market, aiming for a retest of $3,867.

Medium-Term View : 4H Chart Levels

The 4-hour chart highlights the larger bullish structure. Gold’s upward trajectory has been supported by a clear ascending trendline since mid-September, and the market continues to respect this pattern. The next critical resistance stands at $3,867, which, if broken, could open the door toward the $3,900 psychological level.

On the downside, the $3,787–$3,786 support area remains the most crucial level to watch. A sustained break below this could drag prices back to the $3,717 demand zone. However, the strong bullish candles from last week suggest that buyers are likely to defend these areas aggressively.

Momentum Indicators : RSI and Stochastic

The RSI on multiple timeframes shows that Gold has cooled off from overbought conditions, offering space for buyers to re-enter. Similarly, the Stochastic oscillator on the 4H chart is retracing from extreme highs, pointing to a potential consolidation before another upward leg.

This behavior is typical in trending markets: pullbacks allow new participants to join, preventing price exhaustion and keeping the bullish trend healthy.

Economic Factors Driving Gold :

The latest move in Gold prices is not only technical but also influenced by fundamental dynamics:

-

U.S. Dollar Weakness: The dollar has retreated slightly as traders anticipate softer economic data, boosting demand for commodities priced in USD.

-

Interest Rate Outlook: Markets are weighing the Federal Reserve’s cautious stance on future rate hikes. Expectations that the Fed may pause further tightening are supportive for non-yielding assets like Gold.

-

Geopolitical Risks: Persistent concerns in global markets, ranging from trade tensions to regional instability, continue to fuel safe-haven flows into Gold.

These macro drivers strengthen the bullish case for XAUUSD in the near term.

Key Levels to Watch :

-

Immediate Resistance: $3,867 – If broken, upside momentum may extend toward $3,900.

-

Major Resistance: $3,900 and $3,950 – Next upside targets if bullish momentum accelerates.

-

Immediate Support: $3,786 – Crucial zone aligned with trendline and moving averages.

-

Secondary Support: $3,717 – Strong demand zone where buyers recently stepped in.

-

Major Support: $3,700 – A psychological level that could act as a floor for deeper corrections.

Conclusion :

Gold remains in a strong bullish trend, with the market holding above key supports despite the current pullback. As long as XAU/USD stays above $3,786, the bias remains positive, with $3,867 and potentially $3,900 as the next bullish targets. Only a break below $3,786 would shift momentum toward $3,717 and $3,700.

From a trading perspective, investors should watch for dips into support areas for potential buying opportunities, while monitoring resistance zones for signs of profit-taking. With fundamentals supporting safe-haven demand and technicals confirming the trend, Gold continues to show resilience and could extend gains if market conditions remain favorable.